Get $150. Give $150.1

You Get $150: Enjoy a $150 bonus when you open a new Freedom Checking account.

We Give $150: UHCU will donate $150 to BookSpring for every account opened through this promotion.

Easy and Convenient: Open your account online in just a few minutes.

This offer is for new members only. Texas residents only.2

BookSpring

BookSpring builds early literacy in children and families through healthcare, education, and the community. BookSpring is the leading Central Texas organization focusing on building literacy skills and the motivation to read through increasing home libraries and reading aloud activities for children. With 50 years of experience, BookSpring has taken the best practices of our founding programs and adapted them to the unique needs of Central Texas low-income families. We provide a continuum of early literacy interventions through a theory of change that supports brain development, family interaction, skill-building, and the motivation to read in children from birth through age 12.

United Heritage will donate $150 to BookSpring for every new account opened through this promotional offer. These generous contributions will directly support BookSpring's programs to increase awareness of the importance of reading while providing the tools to do so. Additionally, new members who open accounts will also receive a $150 bonus1, making it a win-win situation for both BookSpring and its supporters.

How to get your $150 bonus:

Explore the Benefits of Banking with UHCU

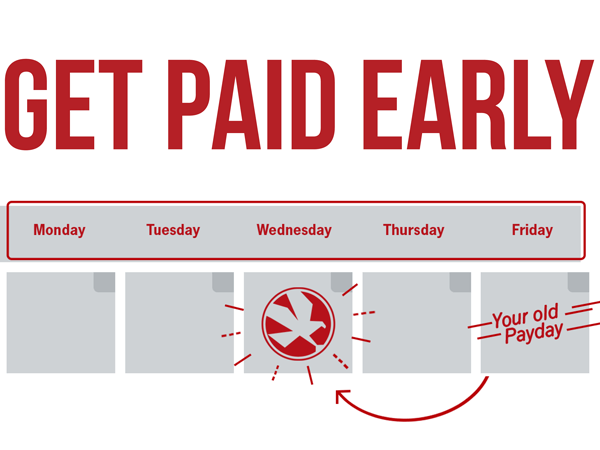

Get Paid Early

Open an account with UHCU and you could get paid up to two days early. It's as easy as 1-2-3.

- Open a UHCU account

- Set up direct deposit for your paycheck

- Receive your paycheck up to two days early****

We Have Loans for Every Need

Auto Loans

Looking for a new or used car loan, or want to refinance your existing loan for lower payments? UHCU auto loans have low rates and flexible repayment options.

Home Purchase

Ready to buy a home? Our experienced loan specialists will assist you from pre-qualification to closing, giving you piece of mind. Apply today to take the first step in your home buying journey.

HELOC

A Home Equity Line of Credit (HELOC) is a variable-rate loan set up as a revolving line of credit. You have access to available loan funds based on an established loan limit using your home as collateral. Funds can be used whenever you want, for whatever you want.

Student Loans

United Heritage Credit Union makes student loans easy. UHCU’s education refinance loan option gives you the freedom and flexibility you need to reach your goals.

1$150 bonus may be taxable interest. Bonus is paid 30 days after the 90-day promotional period. Must use debit card 20 times over 90-day promotional period, ATM transactions excluded. Must opt-in to e-Statements and set up direct deposit with a minimum of two $500 direct deposits into the Checking Account during 90-day promotional period. Offer valid for online account openings only. Business accounts not eligible. Offer not valid for existing UHCU members. Membership required. 2Texas residents only. See Member Eligibility requirements. This promotion is subject to cancellation or modification at any time, without prior notice. We reserve the right to close the promotion or change its terms and conditions, including but not limited to the eligibility criteria, prize descriptions, and promotion period. If the promotion is canceled or modified, we will make reasonable efforts to notify participants, but we are not responsible for any delays or failures in notification.

Membership/Regular or Student Savings required. Regular Savings account required for all checking accounts. Par value of one share is $1. Programs (including, without limit, fees, rates and features) subject to change without notice. See Fee Schedule for applicable fees.

*Web BillPay is free when it is actively being utilized. An inactivity fee of $6.95 is assessed if there is fewer than one (1) payment processed during the Web BillPay calendar monthly billing cycle.

**Overdraft Protection is available for all checking accounts from the designated savings account up to the amount of funds on deposit.

***Excludes overdraft transfers.