Financial

The 5 Pillars of Financial Literacy Everyone Should Know

Let's be real - most of us weren't taught how to manage money in school. Yet, financial literacy is one of the most valuable life skills you can have. It's not just about making mone...

Read More

Managing Debt in 2025: Practical Tips for Financial Freedom

As we begin 2025, many are focusing on financial goals, and for many, that means tackling debt. With rising living costs, it’s important to take a proactive approach to managing what you o...

Read More

What is FAFSA? Securing Financial Aid For Your College Dreams

The Free Application for Federal Student Aid (FAFSA) is your key to unlocking financial aid for college. While it may seem daunting, breaking it down into simple steps can make the process a bre...

Read More

Financial Budgeting for the New Year

Celebrating the New Year is often a time of renewal. We sometimes resolve to make the New Year “our year,” start new diets, begin new exercise regimens and wipe out the things ...

Read More

Managing Credit Card Debt

Credit card debt is one of the biggest financial issues for many Americans. Millions of us carry month-to-month balances on credit cards, and many people have found problems just mak...

Read More

Child Tax Credit Payments - What You Need To Know

The American Rescue Plan, which expanded the income tax credit program for families with children for 2021, has kicked off monthly child tax credit payments that began on 7/15/2021.

Read More

Refinancing Student Loans - What You Need to Know

Student loans can be a huge burden to many Americans, and there has been much talk of government intervention in helping relieve some of the debt, but in the meantime, many are putting up with h...

Read More

5 Reasons to File Your Taxes Early

Doing your taxes early really is worth the effort. The majority of Americans end up with a return, so filing earlier means that for many, you’ll have money back in your pocket sooner. Besi...

Read More

Cutting Your Energy Costs - 10 Easy Ways to Reduce Your Electricity Bill

Reducing your bill can lead to significant long term savings and we’ve got some ideas to help get that cash back into your pocket!

Read More

Top 7 Things to Purchase in January

January is a great time to pick up some great deals, and we’ve compiled a list of the top 7 items that are usually discounted in the New Year!

Read More

5 Steps to Creating a Budget

One of the best decisions you can make for your financial future is to create and then stick to a budget. Taking a deep look at your finances can be intimidating, but it’s important to do ...

Read More

Holiday Budgeting - Avoiding Over Spending

As a country, we generally overspend our budgets each year. A few purchases here and there can really start to add up and with the ease of online shopping and savvy offers from advertisers, it&r...

Read More

Maximize Your Refund with These Tax Tips

Preparation is key to guaranteeing the annual tax deadline doesn't overwhelm you. Check out the following tips on how to reduce stress and increase your refund, or decrease the amount you ow...

Read More

Get Financially Fit This Year

The beginning of the year is a great time to get your finances in order. Though money management can seem a bit daunting at first, it doesn't have to be. Check out our advice below to see ho...

Read More

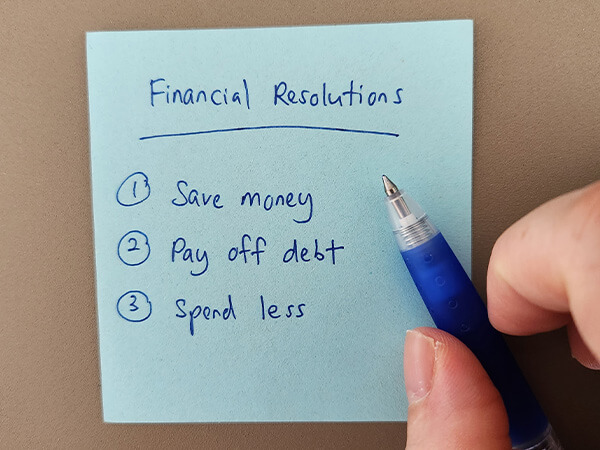

Financial Resolutions for the New Year

We're bringing back our first post of 2014 since it contains a lot of valuable information regarding financial resolutions that are still relevant. One of the best things about beginning a n...

Read More

6 Holiday Travel Tips

This is a great time to visit friends and family. Unfortunately, holiday travel can cause your budget to suffer due to high-priced airline tickets, unexpected lodging expenses and more. Therefor...

Read MoreVirtual Currency: 5 Things to Consider

Although virtual currencies like Bitcoin, Dogecoin and XRP have been receiving a lot of press lately, many people are unaware of what they are, how they’re used or the risks associated wit...

Read More

3 Financial Resolutions

One of the best things about beginning a new year is getting a fresh start. It’s nice to press that imaginary “Reset” button on January 1 and forget about the pitfalls of the p...

Read MoreFinancial FAQ

Saving for College

Saving for your child’s education is an important step for his/her future. With some smart financial maneuvers, you’ll be able to make your money grow, so that by the time high school graduation comes around, funds are available. As important as saving for college is, it’s critical to remember that you should not allocate your retirement savings for college expenses. Securing the funds for a college education is far easier than securing money to see you through retirement.

Start as soon as possible.

Saving now for college ensures that you have the most options available when the time comes. If you feel overwhelmed by such a large, looming expense, consider this: even modest investments can pack a punch. Whatever savings method you choose, it’s important to first do your homework. Consider your needs, objectives and personal financial situation before making your selection.

Savings Accounts:

The Coverdell Savings Account functions similarly to Roth IRAs but, instead of retirement, is instead used for educational expenses. With an annual contribution cap of $2,000, earnings within the account grow tax-free and can be used for any educational expense – not just college tuition.

Stocks:

With tuition costs rising faster than inflation, a portfolio of stocks is a smart way to build savings in the long term. As your child nears the end of high school, you can protect your returns by switching the funds into bonds and cash.

Mutual Funds:

Want to make college funds grow by investing? With a mutual fund, a professional is put in charge of your savings so that you don’t have to watch the market daily.

Texas Tomorrow Funds:

Chances are, you have plenty of time to save for your children’s’ or grandchildren’s’ education. After all, it could be 15 years or more until the money is needed. But have you factored in how much college will cost then? Tuition costs are skyrocketing, rising at a rate of approximately 6 percent a year. The truth is, time is on your side now. By getting a head start, you will be taking one of the most valuable steps to ensuring a good future for your child, grandchild or other loved one. For more information visit the Texas Tuition Promise Fund website.

Membership/Regular Savings account required. Programs (including without limit, fees, rates and features) are subject to change without notice. See rate sheets for applicable dividends. Fees may reduce earnings. Annual contributions cannot exceed $2,000. Consult tax advisor concerning maximum annual contributions and considerations for children with special needs to receive contributions after the child turns 18. Funds must be used for educational expenses and withdrawn before child reaches 30 years of age.

What is a credit union?

A credit union is a member-owned not-for-profit financial institution that exists to serve its members rather than maximize corporate profits. Like banks, credit unions accept deposits and provide lending services. As member-owned institutions, credit unions focus on providing a safe place to save and borrow at reasonable rates. Federally insured credit unions, like United Heritage, are regulated by the National Credit Union Administration and backed by the full faith and credit of the United States Government.

How are financial institutions and consumers impacted by The USA PATRIOT Act?

Consumers and financial institutions are most impacted by the personal identification (ID) portion of the Act, which is designed to reduce the possibility of consumer identity theft. Instances of identity theft have increased in recent years and the Act, along with its Homeland Security features, strives to reduce the possibility of identity theft for each consumer. Financial institutions have the responsibility of verifying and documenting the identity of consumers opening new accounts. Consumers have the responsibility, when opening a new account with a financial institution, of providing acceptable ID and a physical address to verify their identity.

How does my credit score impact my credit and financial future?

A personal credit score is a number that reflects the credit history, debt levels and other credit related items of each consumer. The score represents an individual's creditworthiness. Lenders and other service providers utilize this score as a risk factor indicator and may determine their lending rate or service based on the amount of risk the score represents. The impact on a consumer may be higher loan interest repayment rates or higher service rates if their personal credit score is deemed to indicate a higher financial risk. The timely repayment of debts owed and appropriate management of credit resources allows each consumer the best lending and service rates available in the financial market. For more information on financial tips click here.

What is simple interest and how does it work?

Loans granted with United Heritage are assessed a finance charge by the simple interest method. This means that the interest due whenever a payment is made (regardless of due date) is calculated using the outstanding principal balance and the number of days between payments. The simple interest method allows you to reduce the finance charge on your loan over the term of the loan by: 1) making extra payments of any amount, 2) paying the regularly scheduled payment earlier than due and/or 3) paying the loan off early. Unlike some other lenders, United Heritage does not place all the interest due on the note at the front of the note. Your account statements display your annual percentage rate and your daily periodic loan rate. Using your daily rate, you can figure the interest that will be due when you make your next payment. Formula: Loan balance X periodic rate X number of days between payments. Example:

$1000.00

X.038082

X.30

$ 11.43 Loan Balance

Periodic Rate showing on statement [each loan reflects it own rate]

Number of days between payments

What is the difference between a bank and a credit union?

When you belong to a credit union you’re a member of a not-for-profit financial institution. This means that any profits made go back into the credit union in the form of better rates and lower fees for all members, who own and control the credit union. Credit unions offer many – and, in some cases all – of the same products and services offered by for-profit banks including, checking, savings, loans, and online banking. Credit unions, including United Heritage, even have their own nationwide ATM network. Today’s credit unions remain unique financial institutions with a “not-for-profit but for service” operating philosophy. Annual polls show that credit unions lead the financial community year after year by providing top quality personal service to millions of Americans. A federally insured credit union, United Heritage keeps pace with the needs of our members by offering a variety of products and services.

Other helpful information:

Financial Tips

Whether you're just starting out on your own or considering retirement, there are several financial tips that United Heritage believes apply to everyone.

Building Credit

Understanding the different types of credit and how each affects your financial well-being is crucial. Learn more from United Heritage.

Investing

Making your money work for you through investments takes some know-how. Learn the difference between an IRA, 401k and a typical savings account.