Security

Protect Yourself from Fake Websites

The internet is a fantastic resource, but it's also a breeding ground for scammers. Fake websites, designed to mimic legitimate businesses, are becoming increasingly sophisticated. Read more...

Read More

One-Time Passwords Offer Greater Security

In today's world, security is more important than ever. With the ever-increasing threat of cyberattacks, United Heritage Credit Union is taking every step possible to protect our members'...

Read More

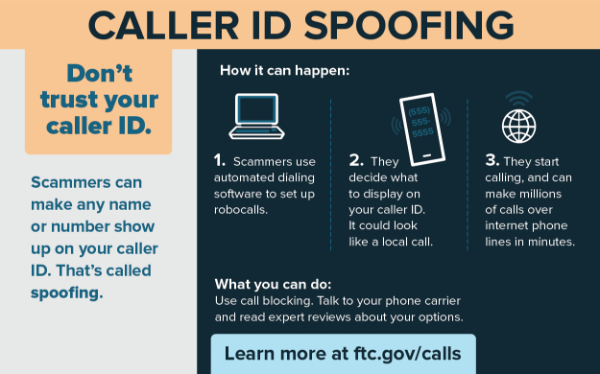

Scam Phone Calls and Texts

The UHCU Fraud Department has received multiple reports from members stating that they are receiving text messages and phone calls from individuals impersonating UHCU employees. Read b...

Read More

Phishing Phone Calls/Texts

We want to inform our members that we have received multiple reports of UHCU members receiving phone calls and text messages from fraudsters indicating that they are a United Heritage representa...

Read More

Phishing Emails: Company Impersonations

In an effort to keep our members informed of current online security threats, we wanted to remind you about a continuing trend we’re seeing from scammers who are impersonating large busine...

Read More

Bank Jugging: What It Is and How to Stay Vigilant

Bank Jugging is when a suspect or suspects observe bank/credit union customers entering and exiting the branch, using the drive-thru or accessing the ATM. The suspect(s) then follow the customer...

Read More

How to Avoid a SMiShing Threat

In an effort to keep our members informed of current security threats, we wanted to let you know about a new trend we’re seeing from scammers who are impersonating large businesses through...

Read More

Phishing Emails: Amazon Impersonation

In an effort to keep our members informed of current online security threats, we wanted to let you know about a new trend we’re seeing from scammers who are impersonating large businesses ...

Read More

Credential Stuffing Attacks on the Rise

Credential stuffing attacks are on the rise and it's important for our members to know how to protect their information online. A credential stuffing attack is when usernames and passw...

Read More

Credential Stuffing Attacks on the Rise

Credential stuffing attacks are on the rise and it's important for our members to know how to protect their information online. A credential stuffing attack is when usernames and passw...

Read More

Reminder: Phishing Phone Calls + Security Pop-Ups

We want to inform our members that we have received reports of UHCU members receiving "Security" pop-ups asking them to call an out-of-area phone number, which is connected to fraudste...

Read More

Phishing Phone Calls

We want to inform our members that we have received multiple reports of UHCU members receiving phone calls from fraudsters.

Read More

SMS Phishing Texts

Be aware that we have received multiple reports of UHCU members receiving a suspicious SMS text message requesting action by the member. We will never request this information from our members, ...

Read More

Fraudulent Checks & the Security of Your Account

While many people are taking advantage of paying their bills through Web BillPay, payment using a paper check may still be preferred in some circumstances to avoid transaction fees, for gift giv...

Read More

4 Types of Student Scams and How to Avoid Them

From registering for classes to finding housing, going back to school for the semester can feel like an endless to-do list. It’s easy to get overwhelmed with forms, payments, and schedules...

Read More

That International Call Could Be a Wangiri Scam

There’s a new robocall scam hitting the mobile phone scene and unlike others, this one is baiting you to call back. Dubbed Wangiri scams – Japanese for “one-ring and cut”...

Read More

3 Steps to Take When Your Card is Compromised

Seeing a fraudulent charge on your credit or debit card may make your heart race, but it’s not a moment to panic. Rather, it’s the time to keep a cool head and take deliberate steps ...

Read More

Debit Card Fraud Monitoring Update

Effective Wednesday, June 5, 2019, our debit card monitoring provider, Falcon Fraud Monitoring, is adding SMS/text messages and email as ways they may contact you to discuss potential fraud atte...

Read More

Tips to Avoid Identity Theft

In this age of information, we’ve all heard stories about identity theft and how rampant it has become. Recent stats and studies on identity theft crimes found that data pirates are becomi...

Read More

Romance Scams

With so many sites, apps, and services dedicated to matching people up, the odds of meeting a compatible mate online have greatly increased over the past several years. However, more free and co...

Read More

Fuel Pump Skimmers

Credit card skimmers are discreet smart devices that hackers, thieves, and scammers have been known to install at credit card terminals to steal information and make fraudulent purchases. Read a...

Read More

Fake Apps Responsible for Banking Fraud

Android phones are extremely popular and therefore are targeted by malicious apps in order to steal banking information.

Read More

Watch Out for These 3 Common Scams

Scams come in many varieties, and millions of people fall victim to them each year. Learn about some of the most common tactics and check out these practical tips to help you spot and avoid scam...

Read More

Beware of Port-Out Phone Scams

Fraudsters are illegally transferring cell phone numbers from one wireless provider to another in what are known as port-out scams.

Read More

Protecting Yourself from Identity Theft

Identity theft occurs when a thief steals someone's personal information to commit fraud. Generally, the thief will use a stolen Social Security number or other personal information to open ...

Read More

Security in the Online Banking Era

What do you need to keep in mind when using online banking in order to stay secure? Read this post for helpful tips.

Read More

IRS Warns of Impersonation Telephone Scam

Scammers impersonating Internal Revenue Service employees are calling taxpayers and claiming they owe the IRS money that must be paid through a pre-loaded debit card or wire transfer. In an effo...

Read More

Protecting Yourself from Email Fraud

United Heritage reminds individuals to never provide an entity they do not know and/or trust with any personal, sensitive information via email.

Read More

4 Scams You Should Know About

As fraud constantly evolves, United Heritage Credit Union reminds members to remain vigilant when it comes to their finances. Outlined in this blog post are a number of common scams that you can...

Read More

Scam Alert: Criminals Hack into Apple Devices to Demand Ransom

Criminals are tricking Apple users into sending them money by hacking in to users' Apple accounts and convincing them that their devices have been compromised via a message on their Apple de...

Read More

Jugging Robbery Trend Targets Bank Customers

In lieu of a recent increase of a crime known as jugging, United Heritage Credit Union would like to remind members to be aware of their surroundings when withdrawing cash.

Read More

Scam Alert: Telephone Wire Request

In light of a recent scam, United Heritage Credit Union urges members to remember to never arrange the transfer of money or provide personal information to unknown entities.

Read More

EMV Cards: What You Need to Know

An EMV card is a standard-size credit or debit card that has a microchip embedded on the front of the card in addition to the traditional magnetic strip on the back.

Read More

Romance Scams Revisited

Each year the popularity of online dating increases, the more people become susceptible to online dating scams. Yet, scammers who troll such social sites use the same-old tactics to swindle thei...

Read More

Bash Bug: What You Need to Know

Security experts have recently discovered a flaw in the system software used within most internet-connected devices –even Mac computers. Shellshock affects the Bash application, software t...

Read More

Security Warning: The Heartbleed Bug

An internet vulnerability affecting roughly two-thirds of all websites was recently discovered. Websites that use free, open source forms of encryption (OpenSSL) are at risk. UHCU’s w...

Read More

Your Security is Our Priority

United Heritage Credit Union considers the protection and security of our members’ personal information a very serious matter. With this in mind, we launched our new Online Banking system ...

Read MoreSecurity News & Updates

Security FAQs

How to Protect Yourself from Fraud

- Always log out after accessing your account online or from a mobile device.

- Never store personal information or passwords on your device.

- Use caution when accessing your account via Wi-Fi, since hotspots can be compromised.

- Never click links in SPAM emails.

- Monitor your financial statements regularly to ensure no suspicious or unexplained activity is present; dispute any activity that looks suspicious as soon as possible.

- Periodically check your credit report to ensure your personal information is accurate.

- Never give your account number or social security number to others and do not send this information via email.

How to Report Fraud

To report fraud on your UHCU account, or if you have any questions regarding activity on your account, call 512.435.4545, 903.597.7484 or 800.531.2328.

How We Protect You from Fraud

- Account numbers are masked on transaction receipts and statements.

- Proper identification is required for all transactions.

- High security, such as multi-factor authentication, is utilized for all online/mobile transactions.

- We offer secure contact via online messaging.

- We never sell or share personal information.

- We offer instant issue debit cards so there is no risk of your debit card being lost in the mail.

- We offer eStatements so that there is no paper trail to dispose of.

- We do not retain your address or domain when you access our website.

- We never ask you via phone, text or email for your account number or social security number.

- We allow you to password protect your account for in-person transactions.

- We use secure, encrypted transmission for member/loan applications and secure eSignature for loan closings.

How are financial institutions and consumers impacted by The USA PATRIOT Act?

Consumers and financial institutions are most impacted by the personal identification (ID) portion of the Act, which is designed to reduce the possibility of consumer identity theft. Instances of identity theft have increased in recent years and the Act, along with its Homeland Security features, strives to reduce the possibility of identity theft for each consumer. Financial institutions have the responsibility of verifying and documenting the identity of consumers opening new accounts. Consumers have the responsibility, when opening a new account with a financial institution, of providing acceptable ID and a physical address to verify their identity.