Hello

Mortgage Rates Just Dropped—Here’s Why Now Is the Time to Buy

If you've been considering buying a home, now might be the perfect opportunity. According to a recent CNBC report, mortgage demand has surged by 11% as interest rates have dropped. Lower rat...

Read More

2025 Observer Volume I

Click here to read our latest Observer newsletter. This volume includes articles on the following topics: Homebuyer Savings Account, debt consolidation, UHCF scholarship updates, Board of Direct...

Read More

Managing Debt in 2025: Practical Tips for Financial Freedom

As we begin 2025, many are focusing on financial goals, and for many, that means tackling debt. With rising living costs, it’s important to take a proactive approach to managing what you o...

Read More

Our Tyler Branch Drive-Thru Services are Changing

We're making some changes at the Tyler Branch to better serve you! Starting Monday, February 24, the drive-thru services are transitioning to our new innovative ATMs. The two drive-up A...

Read More

Mastering Your Finances: Budgeting and Building an Emergency Fund Made Simple

Managing your finances doesn't have to feel overwhelming. With just a few practical steps, you can take control of your money, reduce stress, and set yourself up for future success. Whether ...

Read More

Why Savings Goals Matter

When it comes to creating a successful savings plan, the first and most crucial step is defining a clear savings goal. A goal gives your financial efforts direction, purpose, and a reason to sti...

Read More

Take Your Savings to the Next Level with Smart Investments

Saving money is a great first step, but growing it is how you unlock greater financial potential. Once you’ve built a solid savings foundation, exploring investment options can help you ma...

Read More

Simple Strategies to Save More Without Sacrificing Fun

Saving money doesn’t mean giving up the things you enjoy—it’s about making smarter choices and turning small changes into big opportunities. By identifying unnecessary expenses...

Read More

Smart Ways to Save with United Heritage Credit Union

Saving money doesn’t have to be complicated or stressful—especially when you take advantage of the unique benefits offered by United Heritage Credit Union (UHCU). From competitive ra...

Read More

Smart Saving Strategies

Saving money isn't just about cutting costs - it's about creating habits and systems that make saving easy and effective. If you're ready to take control of your financial future, fo...

Read More

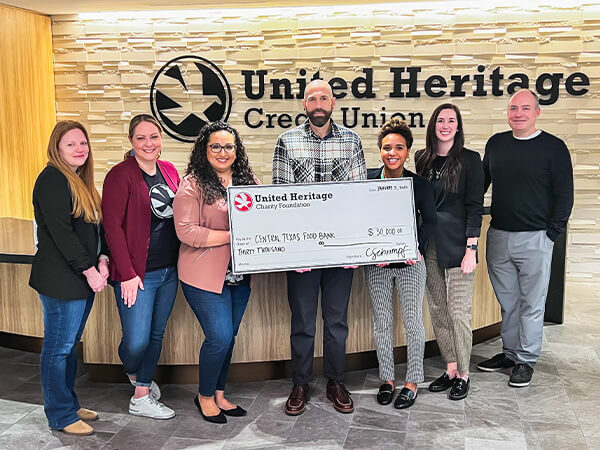

UHCU Partners with Central Texas Food Bank to Combat Food Insecurity in Texas

United Heritage Credit Union (UHCU) is proud to share the success of its partnership with Central Texas Food Bank, which raised funds and provided meals for families facing food insecurity in Te...

Read More

Love Your Savings: 10 Steps to Increase Your Savings

Saving money is one of the smartest financial habits you can develop. Whether you're preparing for a major milestone, planning for retirement, or simply aiming for peace of mind, strong savi...

Read More

United Heritage Credit Union Donates Additional $15,000 to Austin Pets Alive!

United Heritage Credit Union is proud to announce an additional $15,000 donation to Austin Pets Alive! (APA) supporting their lifesaving animal welfare efforts. This donation was made possible t...

Read More

2024 Observer Volume III

Click here to read our latest Observer newsletter. This volume includes articles on the following topics: Financial Report Refer a Friend 2024 Donation Partners and more!

Read More

Save for Your Dream Home with a Homebuyer Savings Account

Are you dreaming of owning your own home? A Homebuyer Savings Account can be a powerful tool to help you reach that goal. These specialized accounts offer a variety of benefits that can make the...

Read More

Bring Joy To A Family Impacted By Abuse

If you want to make a difference by bringing joy to a child who has faced trauma or offering support to a parent in need, we invite you to get involved with Williamson County Children's Advo...

Read More

United Heritage Credit Union Donates $20,000 to BookSpring

United Heritage Credit Union is proud to announce a $20,000 donation to BookSpring through its Charity Foundation. This contribution demonstrates the Foundation's unwavering dedication to fo...

Read More

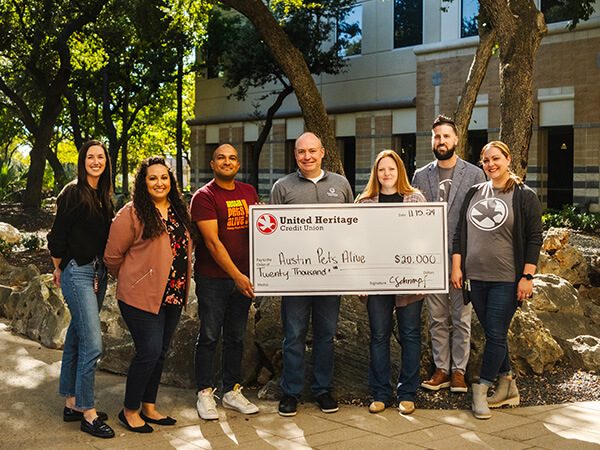

United Heritage Credit Union Donates $20,000 to Austin Pets Alive!

United Heritage Credit Union is proud to announce a $20,000 donation to Austin Pets Alive! through its Charity Foundation. This significant contribution highlights the Foundation's ongoing c...

Read More

2024 Central Texas Food Bank Donation Drive

This holiday season, let's come together to spread warmth, joy, and generosity. United Heritage Credit Union is thrilled to host a donation drive with the Central Texas Food Bank under the h...

Read More

2024 Holiday Toy Drive

United Heritage Credit Union has teamed up with the United Heritage Charity Foundation to host a Holiday Toy Drive from Tuesday, November 12, 2024 to Friday, November 29, 2024 benefiting the Wil...

Read More

Our Southwest Branch is Updating Operating Hours

Effective Saturday, November 23, 2024, our Southwest branch will be closed on Saturdays. Our lobby will remain open and our drive-up ATMs with expanded features will be available. L...

Read More

Free Up Funds with Skip-A-Pay

With our Skip-A-Pay program, you can temporarily pause your loan payment, giving yourself and your budget a much needed break. Click here to learn more about this program.

Read More

Get Assistance Navigating Your Medicare Benefits with UHCU

United Heritage Credit Union strives to provide you with the services and products that will enhance your financial position and create a successful future. Read more to learn how we are he...

Read More

Saving for Your First Home: A Step-by-Step Guide

Saving for your first home requires careful planning and smart financial strategies. This guide offers steps to help you budget, maximize savings, and explore down payment assistance programs to...

Read More

Georgetown Branch Closing for Renovations

The Georgetown branch is being renovated soon. We’re excited to make updates to the interior of this branch in order to improve our members’ experience. Schedule of Closures for Ren...

Read More

United Heritage Credit Union Donates Over 2,000 Supplies to Local Children in Need

Through the generous contributions of our members and employees, we collected and donated over 2,000 school supplies to help local children in need prepare for the upcoming school year. Click to...

Read More

Protect Yourself from Fake Websites

The internet is a fantastic resource, but it's also a breeding ground for scammers. Fake websites, designed to mimic legitimate businesses, are becoming increasingly sophisticated. Read more...

Read More

United Heritage Credit Union Donates $10,000 to Safe in Austin Rescue Ranch

United Heritage Credit Union proudly announces a $10,000 donation to Safe in Austin Rescue Ranch through its Charity Foundation.

Read More

2024 School Supply Drive!

The new school year is fast approaching, and for many families, affording school supplies can be a challenge. United Heritage Credit Union is here to help! We're hosting a School Supply Driv...

Read More

2024 United Heritage Charity Foundation Presents $10,000 in Scholarship Funds

2024 United Heritage Charity Foundation Presents $10,000 in Scholarship Funds

Read More

UHCU Announces Partnership with Austin Pets Alive! to Donate $300 for Every Home Financed

United Heritage Credit Union Announces Partnership with Austin Pets Alive! to Donate $300 for Every Home Financed

Read More

United Heritage Charity Foundation Contributes to New Playground in Tyler!

The United Heritage Charity Foundation is proud to announce its contribution of $20,000 towards the construction of a new playground for PATH’s backyard. This exciting project will provide...

Read More

Navigating the 2024 FAFSA Fiasco: How UHCU Can Provide Financial Relief

At United Heritage Credit Union, we believe in providing support to our members and people in the community at every stage in their life. We recognize that people looking to continue their educa...

Read More

Calling All Texas Homebuyers: It's a Buyer's Market!

Looking to plant roots in vibrant Texas? Here's some exciting news for homebuyers: the market has shifted in your favor! Remember those crazy bidding wars and houses selling above asking pri...

Read More

What Determines the Price of an Auto Insurance Policy?

Ever wonder what factors determine the cost of your auto insurance? The answer lies in the varying factors that insurance companies use to determine your individual risk profile and, ultimately,...

Read More

Does Filing an Auto Insurance Claim Mean Higher Premiums?

Hit a bump in the road with your car? While accidents happen, navigating the aftermath, especially when insurance is involved, can feel like a winding road. One question that often pops up: &quo...

Read More

Don't Get Blindsided: Understanding Auto Policy Cancellation vs. Nonrenewal

Ever wondered why your auto insurance might not be renewed? It's a scenario that raises eyebrows and questions. At UHCU Insurance Services, we believe navigating the twists and turns of insu...

Read More

8 Auto Insurance Myths

Confused about auto insurance? You're not alone. Many myths and misconceptions swirl around this essential protection, leading to costly coverage gaps or overspending. At UHCU Insurance Serv...

Read More

2024 Observer Volume I

Click the image below to read our latest Observer newsletter. This volume includes articles on the following topics: UHCF Scholarship Entry Information 2024 Board Nominations Your B...

Read More

United Heritage Credit Union Saddles Up as Presenting Sponsor for Rodeo Austin's Cowboy Breakfast

AUSTIN, Texas (February 27, 2024) – United Heritage Credit Union, a leading Texas financial institution committed to serving the community, is proud to announce its sponsorship as the Pres...

Read More

What is Covered By an Auto Insurance Policy?

Hitting the open road feels liberating, but it's crucial to be prepared for the unexpected. And that's where your trusty auto insurance policy comes in – your financial guardian an...

Read More

What is Auto Insurance?

Hitting the gas on your car feels freeing, but the thought of navigating auto insurance can leave you feeling stuck at a red light. UHCU Insurance Services is here to shed light on the intricaci...

Read More

Online/Mobile Banking Got a Redesign

Your Online and Mobile Banking Homepage Has a New Look as of February 27, 2024! Click here to learn more.

Read More

United Heritage Charity Foundation Donates $20,000 to Local Military and Their Families for the Holidays

United Heritage Credit Union and its Charity Foundation have partnered with Heroes Night Out, a local non-profit dedicated to supporting active military, veterans, and their families. United Her...

Read More

2023 Donation Drive

We are excited to announce that UHCU is hosting a Donation Drive to benefit Heroes Night Out, a non-profit organization that is dedicated to providing resources and services to local Veterans, S...

Read More

Stay Vigilant and Avoid Scams: Protecting Yourself on Social Media

As the holiday season approaches, United Heritage Credit Union is spreading cheer with an exciting giveaway on our social media platforms. However, amidst the festive spirit, scammers are lurkin...

Read More

United Heritage Credit Union Sponsors Honor Flight Austin

United Heritage Credit Union and its United Heritage Charity Foundation are directly supporting local military veterans in the Austin area. On October 27, a group of volunteers, guardians, and m...

Read More

Step-by-Step Guide: Hail Damage Next Steps

A recent hailstorm caused widespread damage to homes and cars in our community. If your home or car was damaged in the storm, you may be wondering what to do next.

Read More

2023 Teacher Wishlist Giveaway

United Heritage Credit Union and its Charity Foundation directly supported local teachers within Texas to ease the burden of costs teachers pay out of their own pockets. Focusing on education is...

Read More_1.jpg?width=4032&height=3024&ext=.jpg)

2023 School Supply Drive

United Heritage Credit Union (UHCU) recently donated a variety of school supplies, including backpacks, binders, markers, and folders, to two charitable organizations in Central and East Texas: ...

Read More

UHCU Has New ATMs

We're excited to have installed new ATMs at all of our branch locations! These new ATMs offer a variety of features that will make it easier and more convenient for you to complete your bank...

Read More

Our Tyler Branch is Updating Operating Hours

Effective Saturday, September 23, 2023, our Tyler branch will have updated hours of operation on Saturdays to better serve our members. Lobby Monday – Friday: 9:00 AM – 5:00 PM ...

Read More

River Place Branch Closing for Renovations

The River Place branch is being renovated soon. We’re excited to make updates to the interior of this branch in order to improve our members’ experience. Schedule of Closure...

Read More

Don't Fall for Smishing: How to Spot and Avoid These Scams

In an effort to keep our members informed of current security threats, we wanted to let you know about a new trend we’re seeing from scammers who are impersonating financial institutions v...

Read More

Lakeway Branch Closing for Renovations

The Lakeway branch is being renovated soon. We’re excited to make updates to the interior of this branch in order to improve our members’ experience. Schedule of Closures for Ren...

Read More

2023 School Supply Drive!

Back-to-school is just around the corner, and that means it's time to start thinking about school supplies. But for many families, the cost of school supplies can be a financial burden. That...

Read More

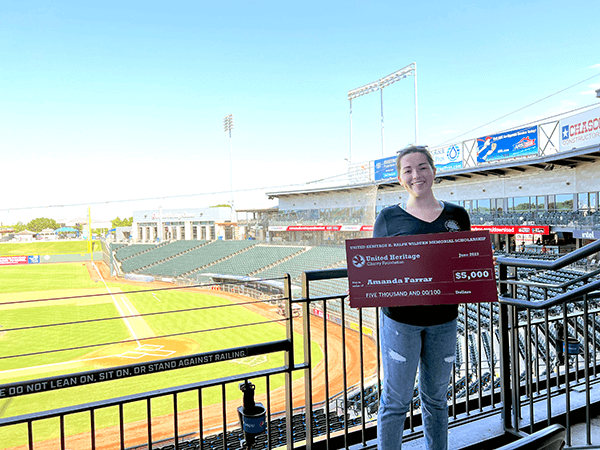

United Heritage Charity Foundation Presents Annual $5,000 Scholarship

The United Heritage H. Ralph Wilburn Memorial Scholarship Committee presented a $5,000 scholarship to Amanda Farrar on June 25 at the Dell Diamond in Round Rock, Texas.

Read More

Round Rock Branch Closing for Renovations

The Round Rock branch is being renovated soon. We’re excited to make updates to the interior of this branch in order to improve our members’ experience. Schedule of Closures for ...

Read More

Don't Wait to Buy a Home - Here's Why

As a potential homebuyer, you might be tempted to wait out the current high-interest rates with the hope that they'll drop soon. However, according to real-world scenarios, waiting might not...

Read More

One-Time Passwords Offer Greater Security

In today's world, security is more important than ever. With the ever-increasing threat of cyberattacks, United Heritage Credit Union is taking every step possible to protect our members'...

Read More

2023 Diaper Drive Benefiting PATH!

We are excited to announce that for the month of April, United Heritage will be supporting PATH as its Diaper Drive sponsor of the month! The United Heritage Charity Foundation has been working ...

Read More

UHCU Sponsoring the 2024 Red Poppy Festival in Georgetown, TX

United Heritage Credit Union will be sponsoring the 2024 Red Poppy Festival in Georgetown, Texas from April 26 to April 28! Join us at the United Heritage booth for a chance to win fun prizes, g...

Read More

United Heritage Credit Union Names New President and CEO

AUSTIN, Texas (February 1, 2023) – The United Heritage Credit Union Board of Directors is pleased to announce the appointment of Michael Ver Schuur as the new President and Chief Executive...

Read More

2022 Observer Volume III

The 2022 Observer Volume III examines maximizing your home's equity, the 2022 UHCF Scholarship and Auto Raffle winners, credit union updates and more!

Read More

Maximizing Your Home's Equity

The odds are good that your home is one of your largest investments and if you have equity in your home, it may be one of the best and easiest financial tools to use when you need cash. Leveragi...

Read More

Notice of Discontinuation: UHCU Shared Branching

UHCU is discontinuing participation in the Co-Op Shared Branching network as of Monday, January 23, 2023. If you use Shared Branching to access your UHCU account read more for alternate options.

Read More

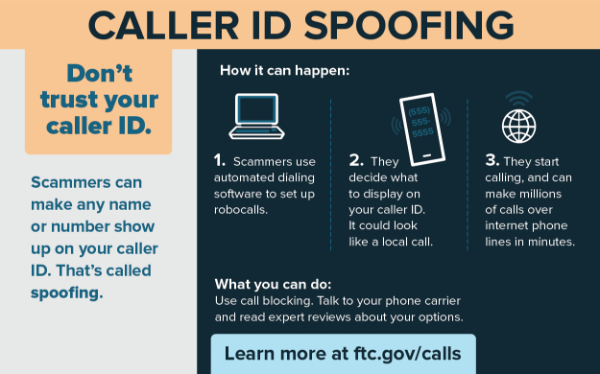

Scam Phone Calls and Texts

The UHCU Fraud Department has received multiple reports from members stating that they are receiving text messages and phone calls from individuals impersonating UHCU employees. Read b...

Read More

Notice of Discontinuation: UHCU Finance Manager

The UHCU Finance Manager service in Online Banking will be discontinued on Thursday, March 31, 2022. Please read more for guided instructions on exporting your account activity..

Read More

Planning for Your Next Vacation

Once the holidays are over and we are back to the everyday grind of work and school, it is no wonder that many of us start to dream about warm weather, vacations and time to actually relax. ...

Read More

Setting and Reaching Your 2022 Goals

There’s a lot of talk around the new year about setting new goals and revitalizing old ones. Each January, we declare that this is the year where we will get healthier, get a better ...

Read More

What Is Passive Income and How Can It Work For You?

If there’s anything that the last few years have taught us it's that every plan should have a backup plan. Financially, there are several ways to create security around an income...

Read More

Top 3 Things To Winterize Your Home

Generally, Texas doesn’t get serious cold weather, but when we do, it’s usually a whopper of a storm. Being prepared for winter is easier than having to fix things when the wea...

Read More

Updating Your Home After The Holidays

In the last few years, homeowners have seen a wave of new technology designed to make our homes smarter, more efficient and easier to maintain. Now it is not at all uncommon to have a robo...

Read More

What You’ll Need to Apply for a Home Loan

No matter where you apply for a home loan, the process always requires many similar documents and kinds of information from you, the borrower. Lenders may have their own unique forms and r...

Read More

Best and Worst Driving Habits – Something for Everyone!

Americans love their cars, and finding joy in driving seems to be a truly American trait. In most areas in Texas, a personal car is still the easiest way to get around. If you’re one of th...

Read More

Winter is Coming: Prepping Your Car for Cold Weather

Although winter temperatures in Texas are generally mild in comparison to northern areas of the country, we’ve been known to have a few cold snaps that could leave some drivers unprepared....

Read More

5 Tips When Researching a New Car

Purchasing a new car is a big commitment and can often be the biggest purchase a person makes, after their home. Like buying a home, plenty of research should be done before you consider buying....

Read More

What Does Servicing My Loan Mean?

When you start drilling down into the world of real estate mortgage loans, as you’ve no doubt already noticed, you’ll discover a new world of terms and acronyms that seem designed to...

Read More

What Happens Next After You Apply for an Auto Loan?

The loan process can seem a little mysterious to potential borrowers; you research loan rates, study different lenders and their loan principles, send in an application and wait for approval. Bu...

Read More

Home-buying Trends: Second Homes

The current housing market remains hot and despite the stiff competition for property, buying a second home is becoming more and more common. And it’s happening closer and closer to ...

Read More

Phishing Phone Calls/Texts

We want to inform our members that we have received multiple reports of UHCU members receiving phone calls and text messages from fraudsters indicating that they are a United Heritage representa...

Read More

What Types of Loans Are There?

When you’re interested in buying a home, one of the first things you should do is compare different types of real estate loans. At United Heritage Credit Union, you’ll have several o...

Read More

Phishing Emails: Company Impersonations

In an effort to keep our members informed of current online security threats, we wanted to remind you about a continuing trend we’re seeing from scammers who are impersonating large busine...

Read More

Child Tax Credit Payments - What You Need To Know

The American Rescue Plan, which expanded the income tax credit program for families with children for 2021, has kicked off monthly child tax credit payments that began on 7/15/2021.

Read More

How to Choose the Right Loan?

When you’re trying to decide on whether to rent, buy, or build, our loan specialists are great at helping you decide the right next step is in your housing journey. United Heritage Credit ...

Read More

Tips for Buying Your First Car

Buying your first car is exciting, but can also be a bit nerve-racking. With a little planning and a bit of research, you can make the process easier and faster. Doing some homework before...

Read More

Loan Estimates – What You Need to Know

When you’re looking to finance a home there are several things you need to consider, including the loan estimate, which is key in understanding the actual terms of the loan. The loan estim...

Read More

Refinancing Student Loans - What You Need to Know

Student loans can be a huge burden to many Americans, and there has been much talk of government intervention in helping relieve some of the debt, but in the meantime, many are putting up with h...

Read More

APR and Interest Rates - What’s the Difference?

Mortgages seemingly have their own language, and knowing what the terms mean can make a significant difference in how you understand your loan and the associated costs. Often, APR is confused wi...

Read More

Should I Sell or Remodel My Home?

Despite the global pandemic, the housing market across Texas has been hot, but mostly for sellers. Housing inventory remains low and often homes are being sold within days of being listed, and a...

Read More

What Communication to Expect During the Home Loan Process

Buying a home is most likely the biggest financial transaction you may make in a lifetime and communication is key to limiting stress during the home loan process. While hiccups can happen in th...

Read More

Is Now the Time to Buy a Home?

Current mortgage rates have been the lowest offered in decades and the housing market has been booming. While the current market has been considered a seller’s market due to the increased ...

Read More

What to do if you don’t qualify for the loan amount you wanted?

You’ve made the big decision to buy a home and gone through the application process only to find out that you don’t qualify for the amount you wanted. Now what? You’ve got some...

Read More

How to Make Your Home Offer Stand Out in a Competitive Market

Housing markets across Texas are booming and mortgage rates are lower than they’ve been in years, so there’s hefty competition in the buying market. Frequently homes have offers on t...

Read More

Now Is the Time to Plan Your Summer Getaway

Now that a COVID-19 vaccine is becoming more widely available, it looks like there may be an end to our time in quarantine. This means that all the things we’ve put on hold like vaca...

Read More

Boost Your Auto Buying Power - Get Pre-Qualified

We’ve mentioned before how getting pre-qualified for an auto loan can increase your buying power, but what does that mean exactly? We’ll outline how doing some planning before you sh...

Read More

What are QR Codes and How Do I Use Them?

For those who aren’t familiar with them, QR codes are a sophisticated form of a bar code that can be scanned using the camera app on most smart phones. QR actually stands for “Quick ...

Read More

5 Reasons to File Your Taxes Early

Doing your taxes early really is worth the effort. The majority of Americans end up with a return, so filing earlier means that for many, you’ll have money back in your pocket sooner. Besi...

Read More

6 Things to Know About Relocating to Austin

Austin is an amazing and fun city and there are a plethora of reasons to move here - great weather, the food scene and the booming job market are all reasons why people are flocking to Austin in...

Read More

Presidents Day 2021: Get the Best Car Deals

There’s no better way to honor the birth of our first president, George Washington, than to spend a few pieces of paper adorned with his image. And the best place to get the biggest bang f...

Read More

Bank Jugging: What It Is and How to Stay Vigilant

Bank Jugging is when a suspect or suspects observe bank/credit union customers entering and exiting the branch, using the drive-thru or accessing the ATM. The suspect(s) then follow the customer...

Read More

How to Avoid a SMiShing Threat

In an effort to keep our members informed of current security threats, we wanted to let you know about a new trend we’re seeing from scammers who are impersonating large businesses through...

Read More

Cutting Your Energy Costs - 10 Easy Ways to Reduce Your Electricity Bill

Reducing your bill can lead to significant long term savings and we’ve got some ideas to help get that cash back into your pocket!

Read More

Top 7 Things to Purchase in January

January is a great time to pick up some great deals, and we’ve compiled a list of the top 7 items that are usually discounted in the New Year!

Read More

5 Steps to Creating a Budget

One of the best decisions you can make for your financial future is to create and then stick to a budget. Taking a deep look at your finances can be intimidating, but it’s important to do ...

Read More

Holiday Budgeting - Avoiding Over Spending

This year has been unprecedented, and many of us have adapted to online shopping, and therefore an increase in our online spending. As a country, we generally overspend our budgets each year. A ...

Read More

Leasing vs. Purchasing a Car: What You Should Know Before You Start Shopping

If you’ve been shopping for a new car or truck, it’s very likely that you’ve seen some great pricing on auto advertisements. Most feel as if they are geared towards buyers with...

Read More

Phishing Emails: Amazon Impersonation

In an effort to keep our members informed of current online security threats, we wanted to let you know about about a new trend we’re seeing from scammers who are impersonating large busin...

Read More

Credit Union Auto Loans - More Than Just a Loan

One of the most exciting parts of shopping for a new car is the seemingly endless options available. You’ve got heated seats, cooled steering wheels and third row options galore, but you a...

Read More

Auto Loans 101: How to Navigate the Car Financing Process

Buying a car is exciting and can be overwhelming with choices. Should you buy new or used? Should you get the car from a dealership or via a third party? Should you lease or buy? Do you get thos...

Read More

Get the Most Out of Your Auto Loan

Car loans are more straight-forward than some might think; you find a car you like and can reasonably afford, you finance the car and drive it off the lot. Sometimes this can happen in the span ...

Read More

Credential Stuffing Attacks on the Rise

Credential stuffing attacks are on the rise and it's important for our members to know how to protect their information online. A credential stuffing attack is when usernames and passw...

Read More

PO Box Update

Please note that our PO Box address has changed to: PO Box 202020; Austin, Texas 78720. Please update your records for any future mailings.

Read More

Down and Detailed: All About Down Payments

Purchasing a home for the first time is a major financial milestone. Along the way, you’re bound to have questions. How much money will I need to put down? How will my down payment affect ...

Read More

UHCU Mobile App Android Update: Mobile Deposit Photos

As we continue to evolve our digital services, we wanted to make our Android users aware of an update coming soon to the UHCU Mobile App. This update is specific to the Mobile Deposit feature wi...

Read More

Buying a Home from Home

In the past, buying a home remotely was usually reserved for special cases such as vacation homes or because of a relocation. However, given our new norm of social distancing, buying a new home ...

Read More

Credential Stuffing Attacks on the Rise

Credential stuffing attacks are on the rise and it's important for our members to know how to protect their information online. A credential stuffing attack is when usernames and passw...

Read More

Reminder: Phishing Phone Calls + Security Pop-Ups

We want to inform our members that we have received reports of UHCU members receiving "Security" pop-ups asking them to call an out-of-area phone number, which is connected to fraudste...

Read More

Supporting the Financial Well-Being of Our Communities

United Heritage is your foundation of economic well-being. While there is a lot of talk of being here for you, we mean it. We are expanding our services and offerings while others are scaling ba...

Read MoreReminder: Suspicious SMS Texts

UHCU has received multiple reports of members receiving a suspicious SMS text message requesting action by the member. We will never request this information from our members, including the last...

Read MoreYour Funds are Safe

We wanted to remind our members that the safest place for your funds right now is in the financial institution systems. UHCU will continue to provide members with access to their funds directly ...

Read More

Spring is Coming – Considering a Refinance?

With spring just around the corner, is there a best time of the year to refinance your mortgage? That’s a question that only you will know the answer to—after all, everyone’s n...

Read More

Why You Should House Hunt in the Winter

When we think of going house hunting, we tend to picture sunny skies and spring time, not cold and dreary days. Don’t let that scare you, as there are actually several advantages to h...

Read More

Phishing Phone Calls

We want to inform our members that we have received multiple reports of UHCU members receiving phone calls from fraudsters.

Read More

SMS Phishing Texts

Be aware that we have received multiple reports of UHCU members receiving a suspicious SMS text message requesting action by the member. We will never request this information from our members, ...

Read More

8 Best Tips for Holiday Road Trips

Road trips - the quintessential American mode of travel that highlights the joys of the holidays like no other activity. It's a tradition, much like listening to your Uncle’s high scho...

Read More

4 Types of Student Scams and How to Avoid Them

From registering for classes to finding housing, going back to school for the semester can feel like an endless to-do list. It’s easy to get overwhelmed with forms, payments, and schedules...

Read More

Internet Explorer Browser Support Ending

Microsoft announced earlier this year that they plan to end support for most versions of Internet Explorer (IE) in January 2020. Prior to this, support for IE 10 and older ended 1.12.16. What do...

Read More

That International Call Could Be a Wangiri Scam

There’s a new robocall scam hitting the mobile phone scene and unlike others, this one is baiting you to call back. Dubbed Wangiri scams – Japanese for “one-ring and cut”...

Read More

3 Steps to Take When Your Card is Compromised

Seeing a fraudulent charge on your credit or debit card may make your heart race, but it’s not a moment to panic. Rather, it’s the time to keep a cool head and take deliberate steps ...

Read MoreUHCU Coloring Book

We're happy to share our UHCU Coloring Book with everyone! Feel free to print the pages of Beaker and his friends for fun coloring time at home.

Read More

Fraudulent UHCU Official Checks

Recently, United Heritage Credit Union became aware of individuals receiving fraudulent Official Checks containing the UHCU name and logo in the mail along with a pamphlet instructing the recipi...

Read More

5 Tips for Buying a New Car

Whether you're buying a new vehicle or a pre-owned vehicle that’s new-to-you, the experience should feel rewarding. Unfortunately, many people find buying a new car to be stressful. Do...

Read More

6 Budget-Friendly Upgrades to Boost Your Home’s Value

There are only a few weeks left before summer officially begins and if you’re planning on selling your home soon, you should consider devoting some time to small, inexpensive weekend proje...

Read More

7 Steps for First-Time Car Buyers

Are you a first-time car buyer? Before heading to the dealership, check out these steps on how to best buy a car.

Read More

Tips to Avoid Identity Theft

In this age of information, we’ve all heard stories about identity theft and how rampant it has become. Recent stats and studies on identity theft crimes found that data pirates are becomi...

Read More

Romance Scams

With so many sites, apps, and services dedicated to matching people up, the odds of meeting a compatible mate online have greatly increased over the past several years. However, more free and co...

Read More

Fuel Pump Skimmers

Credit card skimmers are discreet smart devices that hackers, thieves, and scammers have been known to install at credit card terminals to steal information and make fraudulent purchases. Read a...

Read More

Phishing Phone Call Alert

We want to inform our members that we have received multiple reports of UHCU members receiving phone calls from fraudsters. Please read the full post for more information.

Read More

Six Helpful Tips for Buying a Home

When it comes to purchasing a new home, using the assistance of experienced UHCU Loan Specialists who know the process inside and out can help make the experience smooth and free of unnecessary ...

Read More

Postcard Scam

We want our members to be aware that fraudulent postcards are being sent to members of credit unions near UHCU.

Read More

Mortgage Terms and Disclosures: Learning a New Language

Purchasing a new home can be as exciting as it is intimidating. In addition to the numerous loan options and payment structures, there are mortgage-related words and terms that might be new to s...

Read More

Expect the Unexpected: The Costs of Buying a House

A first-time homebuyer could easily overlook fees and expenses that come when purchasing a home. That’s why it’s important to learn about all of the costs you will have to budget for...

Read MoreSlaughter Branch Celebrates 10th Anniversary

United Heritage Credit Union’s Slaughter branch, located at 5011 W Slaughter Ln. in Austin, is celebrating its 10th anniversary with a fun, free event on Friday, September 21, 2018 from 3:...

Read More

How to Protect Your Router from Recent Hacks

The FBI recommends that anyone who owns a wireless router reset it as soon as possible due to sophisticated malware that likely comes from Russian state-sponsored hackers.

Read MoreHappy Mother's Day

In honor of Mother's Day, we sat down with a few UHCU employees to talk about their moms and about being a mom. Happy Mother's Day!

Read More

Watch Out for These 3 Common Scams

Scams come in many varieties, and millions of people fall victim to them each year. Learn about some of the most common tactics and check out these practical tips to help you spot and avoid scam...

Read MoreUpgrade to an EMV Chip Debit Card Today!

EMV Chip Debit Cards are available for United Heritage Credit Union members! Call or stop by any full-service UHCU branch to upgrade your card today.

Read More

Lakeway Branch's 10 Acts of Kindness

United Heritage Credit Union’s Lakeway branch recently celebrated its 10th anniversary with 10 Acts of Kindness. As a way to say thank you to members and the surrounding community, the Lak...

Read More

Lakeway Branch Celebrates 10th Anniversary

United Heritage Credit Union’s Lakeway branch, located at 3317 S RR 620 in Austin, is celebrating its 10th anniversary with 10 Acts of Kindness! Acts of Kindness include a member lunch on ...

Read More

Beware of Port-Out Phone Scams

Fraudsters are illegally transferring cell phone numbers from one wireless provider to another in what are known as port-out scams.

Read More

Protecting Yourself from Identity Theft

Identity theft occurs when a thief steals someone's personal information to commit fraud. Generally, the thief will use a stolen Social Security number or other personal information to open ...

Read More

Security in the Online Banking Era

What do you need to keep in mind when using online banking in order to stay secure? Read this post for helpful tips.

Read More

IRS Warns of Impersonation Telephone Scam

Scammers impersonating Internal Revenue Service employees are calling taxpayers and claiming they owe the IRS money that must be paid through a pre-loaded debit card or wire transfer. In an effo...

Read More

Update Computer, Phone to Protect from Vulnerabilities

It was recently discovered that nearly all devices with microprocessors, including computers and smartphones, are vulnerable to at least one of two exploits that could allow hackers to steal dat...

Read More

How to Browse Smart Online

As banking and shopping online are increasingly becoming the norm, United Heritage Credit Union reminds members to use caution when online.

Read More

Protecting Yourself from Email Fraud

United Heritage reminds individuals to never provide an entity they do not know and/or trust with any personal, sensitive information via email.

Read More

4 Scams You Should Know About

As fraud constantly evolves, United Heritage Credit Union reminds members to remain vigilant when it comes to their finances. Outlined in this blog post are a number of common scams that you can...

Read More

FCC Warns of 'Can You Hear Me?' Scam Calls

The Federal Communications Commission is alerting the public to recent "Can you hear me?" scams in which fraudulent callers record a victim's voice over the phone. The fraudsters t...

Read MoreUnited Heritage Credit Union Celebrates 60th Anniversary!

Austin-based United Heritage Credit Union is celebrating 60 years of providing members with superior financial services.

Read More

5 Ways for Austin Drivers to Minimize Auto Expenses

Although sitting in traffic can take a toll on the health of your vehicle, following a few simple guidelines can help ensure you're not spending a fortune on your car.

Read More

3 Must-Dos Before Buying a Home in Austin

With an average list price of $414,563 for a four-bedroom, two-bathroom house, Austin-area homes are the most expensive in the Lone Star State. Check out these money-saving tips to ensure you do...

Read More

Beware of Ongoing Telephone, Text Message Scams

In response to a variety of recent telephone and text message scams, United Heritage Credit Union wants to remind members of the common signs associated with financial scams so members can preve...

Read More

Scam Alert: Criminals Hack into Apple Devices to Demand Ransom

Criminals are tricking Apple users into sending them money by hacking in to users' Apple accounts and convincing them that their devices have been compromised via a message on their Apple de...

Read More

Jugging Robbery Trend Targets Bank Customers

In lieu of a recent increase of a crime known as jugging, United Heritage Credit Union would like to remind members to be aware of their surroundings when withdrawing cash.

Read MoreUnited Heritage Community Scholarships Awarded

The United Heritage Community Scholarship Committee presented two $5,000 scholarships to Eliza Cain and Zachary Ray at the 2016 Member Appreciation events.

Read More

Scam Alert: Telephone Wire Request

In light of a recent scam, United Heritage Credit Union urges members to remember to never arrange the transfer of money or provide personal information to unknown entities.

Read More

How Much Car Can You Afford?

January is typically a slower car-buying month, which opens up the opportunity for potential savings. While acting fast can benefit you financially, it's still important to consider all of y...

Read More

United Heritage Raises $3,450 for Holiday Toy Drive

With the help of members and staff, United Heritage Credit Union collected more than $3,450 worth of toys for the Austin Police Operation Blue Santa program this holiday season.

Read MoreUnited Heritage Named a Top Workplace

United Heritage Credit Union is thrilled to announce we've been named one of the Austin American-Statesman Top Workplaces for 2015! This marks the sixth consecutive year UHCU has made the li...

Read More

United Heritage Credit Union Accepting Donations for Blue Santa

United Heritage Credit Union is holding a toy drive from Monday, November 16 to Friday, December 11 to benefit the Austin Police Operation Blue Santa program. With the help of Austin residents, ...

Read More

EMV Cards: What You Need to Know

An EMV card is a standard-size credit or debit card that has a microchip embedded on the front of the card in addition to the traditional magnetic strip on the back.

Read More

5 Factors that Influence Your Mortgage Interest Rate

If you're in the market for a new home, you're also in the market for a mortgage loan. And when it comes to loans of any type, it's key to work with a lender you trust. That's wh...

Read MoreUHCU.ORG Ranked as Top Responsive Banking Website

Recently the UHCU.ORG website was ranked 7 in The Financial Brand's list of 25 Inspirational & Responsive Banking Website Designs. Responsive websites are those that adjust to the size o...

Read More

Romance Scams Revisited

Each year the popularity of online dating increases, the more people become susceptible to online dating scams. Yet, scammers who troll such social sites use the same-old tactics to swindle thei...

Read More

Protect Your Router

In order to steal personal information, like Online Banking credentials, scammers are now sending emails including links that change the settings on your internet router if clicked. Attacks such...

Read More

UHCU Named to Financial Brand's Power 100

United Heritage is now ranked among the top credit unions in the world (#88) on social media after being named to The Financial Brand's Power 100 list of credit unions.

Read More

IRS-Impersonation Telephone Scam

The Internal Revenue Service (IRS) recently issued a consumer alert regarding an IRS-impersonation telephone scam. The callers claim to be IRS employees, may know information about you and also ...

Read MoreFinancial Resolutions for the New Year

We're bringing back our first post of 2014 since it contains a lot of valuable information regarding financial resolutions that are still relevant. One of the best things about beginning a n...

Read More

6 Holiday Travel Tips

This is a great time to visit friends and family. Unfortunately, holiday travel can cause your budget to suffer due to high-priced airline tickets, unexpected lodging expenses and more. Therefor...

Read MoreVirtual Currency: 5 Things to Consider

Although virtual currencies like Bitcoin, Dogecoin and XRP have been receiving a lot of press lately, many people are unaware of what they are, how they’re used or the risks associated wit...

Read More

Bash Bug: What You Need to Know

Security experts have recently discovered a flaw in the system software used within most internet-connected devices –even Mac computers. Shellshock affects the Bash application, software t...

Read More

First-Time Homebuyer: 10 Steps to Homeownership

Buying a home is an exciting experience, but it can also be overwhelming. It will probably be the single largest purchase you ever make and it requires thoughtful planning. Therefore, all first-...

Read More

How Much House Can You Afford?

If you’re like most Americans, the question isn’t, “Am I going to finance my new home?” But rather, “What mortgage payment can I afford?” Before you beg...

Read More

Security Warning: The Heartbleed Bug

An internet vulnerability affecting roughly two-thirds of all websites was recently discovered. Websites that use free, open source forms of encryption (OpenSSL) are at risk. UHCU’s w...

Read More

How to Avoid Online Dating Scams

Nowadays, millions of people turn to online dating websites to find companionship and romance. Why not, right? The idea and convenience of meeting your soul mate on the internet is allurin...

Read More

UHCU Employees Raise Funds for Dell Children's

United Heritage Credit Union staff members recently raised $460 for Dell Children’s Regional Heart Program by donating $5 each to the charitable organization.

Read More

Your Security is Our Priority

United Heritage Credit Union considers the protection and security of our members’ personal information a very serious matter. With this in mind, we launched our new Online Banking system ...

Read More

Team United Heritage: 2013 Year in Review

Every month of the year you can catch a member of Team United Heritage in an act of kindness. These are Credit Union employees who voluntarily give of their time, participate in fundraising even...

Read More

7 Holiday Fraud Prevention Tips

The holiday season is quickly approaching, which means spending time with family, putting up fun decorations, preparing tasty food and shopping for holiday gifts. Unfortunately, it also means fr...

Read More